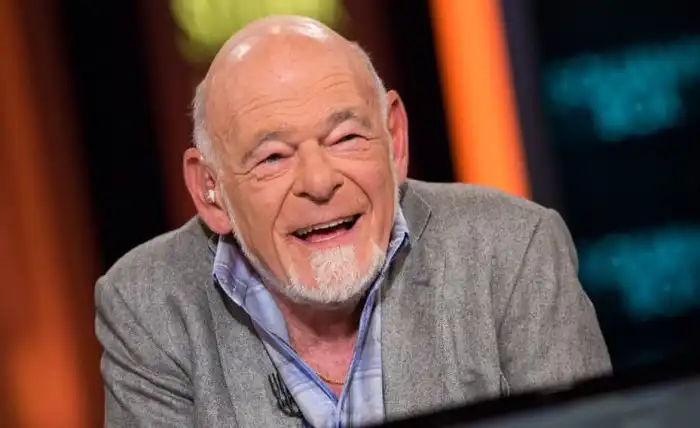

Sam Zell: The Real Estate Billionaire Who Sees Opportunities Everywhere

Sam Zell is a real estate billionaire who is known for his unconventional and contrarian approach to investing. Sam Zell is the founder and chairman of Equity Group Investments, a private investment firm that has interests in various sectors, such as real estate, energy, transportation, media, and health care. Sam Zell is also the chairman of Equity Residential, Equity Lifestyle Properties, Equity Commonwealth, and Covanta Holding Corporation, which are publicly traded real estate investment trusts (REITs) that own and operate residential, commercial, and industrial properties.

Sam Zell was born in Chicago in 1941 to Jewish immigrants from Poland. He grew up in a modest and entrepreneurial family that taught him the value of hard work, risk-taking, and independence. He started his first business at the age of 12, selling comic books and magazines. He graduated from the University of Michigan with a bachelor’s degree in 1963 and a law degree in 1966.

Sam Zell began his real estate career in 1968, when he partnered with his friend Robert Lurie to buy and manage apartment buildings in Chicago. They used their own money and borrowed funds to acquire distressed and undervalued properties that had potential for improvement and growth. They also pioneered the concept of REITs, which are companies that own and operate income-producing real estate and distribute most of their earnings to shareholders as dividends.

Sam Zell earned his reputation as a savvy and opportunistic investor who could spot and exploit market inefficiencies and trends. He was nicknamed “the Grave Dancer” for his ability to buy troubled assets at bargain prices and turn them around for huge profits. He was also known for his colorful and outspoken personality, which often challenged the conventional wisdom and norms of the industry.

Sam Zell has been involved in some of the most notable and successful deals in the history of real estate, such as:

- Buying the Sears Tower (now Willis Tower) in Chicago for $840 million in 1990 and selling it for $1.3 billion in 2004.

- Buying the Rockefeller Center in New York for $1.85 billion in 1996 and selling it for $2.2 billion in 2000.

- Buying Tribune Company, the owner of newspapers such as the Chicago Tribune and the Los Angeles Times, for $8.2 billion in 2007 and taking it private.

- Selling Equity Office Properties Trust, the largest office landlord in the US, to Blackstone Group for $39 billion in 2007, which was the largest leveraged buyout at the time.

Sam Zell has also been involved in some of the most controversial and challenging deals in the history of real estate, such as:

- Buying Anixter International, a cable and wire distributor, for $543 million in 1986 and taking it public in 1995. The deal was criticized by some shareholders who accused Sam Zell of self-dealing and conflicts of interest.

- Buying Schwinn Bicycle Company, a legendary bike maker, for $86 million in 1993 and selling it for $151 million in 1997. The deal was criticized by some employees and customers who accused Sam Zell of neglecting and destroying the brand and its quality.

- Buying Jacor Communications, a radio broadcaster, for $620 million in 1993 and selling it to Clear Channel Communications for $4.4 billion in 1999. The deal was criticized by some regulators and activists who accused Sam Zell of contributing to the consolidation and homogenization of the media and its content.

Sam Zell has also been involved in some of the most philanthropic and generous acts in the history of real estate, such as:

- Donating $100 million to the University of Michigan’s business school in 2013, which was renamed as the Ross School of Business.

- Donating $60 million to the University of Chicago’s law school in 2017, which was renamed as the Law School.

- Donating $18 million to the Museum of Contemporary Art Chicago in 2017, which was used to create an endowment and a free admission program for visitors.

How to Hire a Real Estate Consultant Like Sam Zell?

If you want to hire a real estate consultant like Sam Zell, you need to look for someone who has:

- A proven track record of success and experience in the real estate industry, especially in different sectors, markets, and cycles.

- A unique and creative approach to investing, that can identify and capitalize on opportunities that others may overlook or ignore.

- A strong and independent personality, that can challenge and inspire you to think differently and act boldly.

You can use online platforms such as [LinkedIn] or [Google] to search for profiles, reviews, or feedback on local or online consultants who match these criteria. You can also use referrals from your friends, family, or colleagues to get recommendations or testimonials on reliable or reputable consultants.

Conclusion

Sam Zell is a real estate billionaire who is known for his unconventional and contrarian approach to investing. Sam Zell is the founder and chairman of Equity Group Investments, a private investment firm that has interests in various sectors, such as real estate, energy, transportation, media, and health care. Sam Zell is also the chairman of several publicly traded REITs that own and operate residential, commercial, and industrial properties.