What is the Russell 2500 Index and How to Invest in It?

The Russell 2500 Index is a stock market index that tracks the performance of 2,500 small-cap and mid-cap companies in the United States. It is one of the most comprehensive and unbiased indexes in the market, covering a wide range of industries and sectors. The index is designed to offer investors exposure to the growth potential and diversification benefits of the “smid” cap space, which can range from $300 million to $10 billion in market capitalization.

How the Index is Constructed

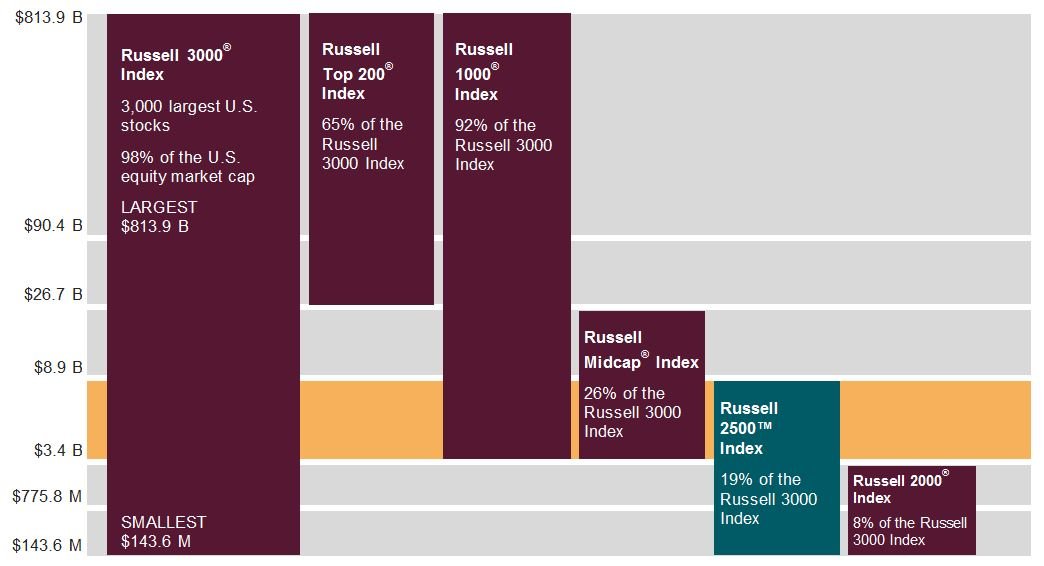

The Russell 2500 Index is part of the Russell family of indexes, which are maintained by FTSE Russell, a leading global index provider. The index is derived from the Russell 3000 Index, which covers approximately 98% of the U.S. equity market. The Russell 2500 Index consists of the smallest 2,500 companies in the Russell 3000 Index, based on their float-adjusted market capitalization. The index is reconstituted annually in June, using the market values as of the last trading day of May. The index is also rebalanced quarterly to reflect changes in the market.

The index uses a market-cap-weighted methodology, which means that each company’s weight in the index is proportional to its market value. This ensures that the index reflects the performance of the market as a whole, rather than being dominated by a few large companies. The index also applies some eligibility criteria for inclusion, such as trading on major U.S. exchanges, having a minimum market value of $30 million, and meeting certain liquidity and profitability thresholds.

What are the Characteristics and Benefits of the Index?

The Russell 2500 Index offers investors a broad and representative exposure to the U.S. small-cap and mid-cap segments, which are often overlooked or underrepresented by other indexes. The index covers a diverse range of industries and sectors, with the top three being financial services, producer durables, and consumer discretionary. The index also has a higher growth orientation than large-cap indexes, as smaller companies tend to have higher earnings growth potential and innovation capabilities.

The index also offers some diversification benefits for investors, as it has a low correlation with other asset classes, such as bonds, commodities, or international equities. The index also has a lower volatility than pure small-cap indexes, as it includes some mid-cap companies that have more stability and resilience. The index can also capture some merger and acquisition activity, as smaller companies are more likely to be acquired by larger ones.

How to Invest in the Index?

Investors who want to invest in the Russell 2500 Index can do so through various vehicles, such as mutual funds, exchange-traded funds (ETFs), or index futures and options. Some examples of mutual funds that track the index are the iShares Russell Small/Mid-Cap Index Fund and the Vanguard Russell 2500 Index Fund. Some examples of ETFs that track the index are the iShares Russell 2500 ETF and the SPDR Russell 2500 ETF. These funds aim to replicate the performance of the index by holding a representative sample or all of its constituents.

Investors can also trade futures and options contracts on the Russell 2500 Index through CME Group, which offer leverage, liquidity, and hedging opportunities. These contracts are based on the value of $100 times the index level and have quarterly expiration dates.

Read more about: kokoa-tv

Conclusion

The Russell 2500 Index is a comprehensive and unbiased stock market index that tracks the performance of 2,500 small-cap and mid-cap companies in the U.S. The index offers investors exposure to the growth potential and diversification benefits of the “smid” cap space, which covers a wide range of industries and sectors. The index can be accessed through various investment vehicles, such as mutual funds, ETFs, or futures and options contracts. The index is suitable for investors who are looking for long-term capital appreciation and risk-adjusted returns.

Read more about: web3rdgen